Emerging from COVID – the lasting impact on the CRE finance market in Europe

By Dean Harris

We entered 2021 with COVID still very much in the ascendancy and the UK government being forced to announce the third nationwide lockdown in an attempt to control the infection rate. Notwithstanding this, sentiment in the CRE finance sector remained cautiously positive. At Trimont, we noticed a substantive increase in new loan activity as we approached the end of Q1, which continued as the vaccine programme gathered momentum. But when we analyse market activity in more detail, the longer-term impact of the pandemic emerges.

It is interesting to note how the onset of the pandemic in 2020 and 2021 led to a change in the types of lenders compared with those more prevalent pre-pandemic. Of Trimont’s new mandates in 2021, a larger number than we have seen historically were on behalf of non-bank lenders, who were quick to fill the void left as some banks reduced their new loan originations during this period.

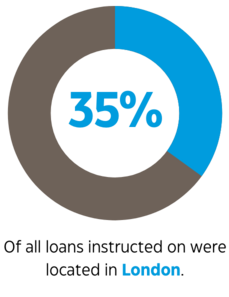

Our pan-European presence also provided us with an insight into the jurisdiction in which our clients focused their investing across the European continent. It is clear that London remains an attractive location, accounting for 35% of all loans that we were instructed on during 2021 (with offices (33%) and residential / student accommodation (55%) making up the bulk of these loans. Furthermore, 34% of the loans we were instructed on in 2021 were secured against assets across the rest of the UK (split as to 51% logistics, 29% hospitality and leisure and 10% each for office and residential / student).

The remaining 31% of loans were secured against assets across several European jurisdictions, with logistics being the preferred and dominant sector. Given the uncertainty Covid created, it is not surprising that lenders continue to focus on jurisdictions that could be considered more “creditor friendly.” 87% of Trimont’s new European business in 2021 was in the UK, Ireland and the Netherlands, continuing a trend we witnessed in 2020.

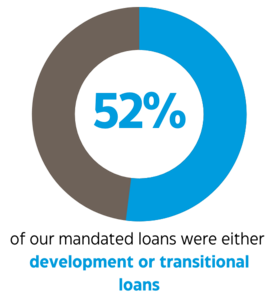

Analysing lending activity during 2021, we also noted that 52% of the loans on which we were mandated were either development or transitional loans. This could be, in part, down to our specialisation in servicing more complex loans, but it also reflects the way the market is adapting to new challenges and opportunities. It may also speak to the difficulty of underwriting in place income and tenant creditworthiness with a backdrop of lock-downs, eviction moratoriums and stay at home mandates making investment loans less appealing. Demands to make buildings more efficient, more amenable and healthier for occupants are being driven by investors, and lenders have shown an appetite to support these projects.

Our analysis of the geographical make-up of these development loans revealed that London accounted for 45% of these loans, followed by Europe (39%) and the rest of the UK (16%). In London, more than half of the loans provided, 53%, were to finance the development of residential assets, as the demand in the Build to Sell and Build to Rent sectors showed no sign of slowing down. Residential being the sector least affected by lock-downs and moratoriums.

Student accommodation accounted for 18% of development loans, underpinned by the demand for higher quality purpose-built accommodation with better service provisions. Notwithstanding widespread coverage regarding the uncertain future of the office in the post-COVID world, we witnessed continued lender activity in this area, with 29% of loans being provided to support the development or repositioning of office accommodation in the capital suggesting lenders are backing the future of the prime office market in London. Lending activity on grade B office space remains subdued when compared with pre-pandemic levels.

Turning our focus to the 39% of development loans provided in Europe, logistics were the most sought-after asset class for lenders, accounting for 66% of these loans, with the balance secured on offices (24%) and residential / student accommodation (10%).

The rest of the UK was a less attractive market for lenders actively looking for development opportunities. Of the 16% of development loans provided in the regions, 67% went into logistics, feeding the demand created by a growing on-line retail sector and the need to move consumer products around the country. There was less demand for office and, perhaps surprisingly, residential development, with each seeing 17% and 16% of the loans respectively.

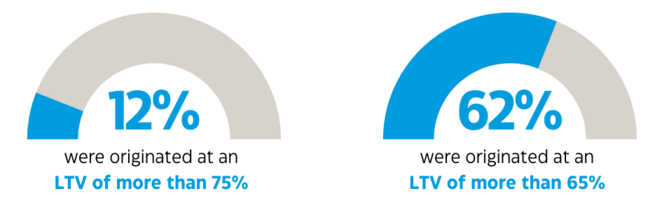

Looking further into the details of the loans we are mandated on in 2021, we find that the number of loans made with high LTVs (i.e., more than 75% LTV) remains low. Just 12% were originated at an LTV of more than 75% (and the majority of these were secured against student accommodation), whilst 62% of mandates were at 65% or lower LTV’s, reflecting the continued considered approach by lenders.

What does this tell us? Well, in short, 2021 has been a year in which lender caution and risk have been carefully balanced. Whilst we have seen an increase in the number of development and transitional loans originated, loans continue to be well structured, with no notable increase in LTVs witnessed during the period. It also shows that lenders have been willing to support sponsors in the repositioning or development of office, residential, student and logistics assets. If you are a lender who has been active in any of these sectors, we hope that you are encouraged to see others have followed the same path.

At Trimont, we work closely with lenders as their trusted partners, allowing us to share and provide our knowledge and expertise of, but also to gain valuable insight into, the CRE markets in which we and our clients operate. We look forward to developing these relationships in 2022 and beyond.

To learn more or speak with someone at Trimont, please click here.

As Executive Managing Director for Trimont in EMEA, Dean Harris is the lead contact for our clients, prospects, rating agencies and regulators in Europe. In his role, Dean oversees Trimont’s agency, servicing, loan management and advisory businesses for the region. He also serves on Trimont’s Management Committee, working closely with Trimont’s CEO and global leadership team in developing and executing the firm’s strategy.

About Trimont LLC

Trimont (www.trimont.com) is a specialized global commercial real estate loan services provider and partner for lenders seeking the infrastructure and capabilities needed to help them scale their business and make informed, effective decisions related to the deployment, management and administration of commercial real estate secured credit.

Data-driven, collaborative and focused on commercial real estate, Trimont brings a distinctive mix of intelligent loan analysis, responsive communications, and unmatched administrative capabilities to clients seeking cost-effective solutions at scale.

Founded in 1988 and headquartered in Atlanta, Trimont’s team of 400+ employees serves a global client base from offices in Atlanta, Dallas, Kansas City, London, New York and Sydney. The firm currently has USD 236B in loans under management and serves clients with assets in 72 countries.